Self-Directed Brokerage Account

With Self-Directed Brokerage Accounts (SBDAs), participants can go beyond their plan’s preselected investment lineup and gain access to a variety of additional investment choices. Participants can take control over their investment decisions and tailor strategies to their goals.

EXPANDED INVESTMENT OPTIONS

Participants can leverage a variety of investment options, including:

- FPLCM Model Portfolios

- Mutual funds

- Interval mutual funds

- ETFs

- CDs

- Unit investment trusts (UITs)

- Individual stocks or bonds

- Structured notes

- Options*

- Private non-traded investments such as BDCs or REITs*

- Private equity funds*

- Private credit/debt funds*

- Private equity real estate funds*

- Hedge funds*

FINANCIAL PROFESSIONAL ACCESS

Participants have the option of managing the SDBA themselves or authorizing a financial professional to assist in managing their account. Participants also have the option to retain the asset management services of FPL Capital Management to manage their account(s).

CUSTODIAN

Participants can establish a Self-Directed Brokerage Account with TD Ameritrade. If a participant utilizes a TD Ameritrade Advisor then the account will be upgraded to a TD Ameritrade Institutional account.

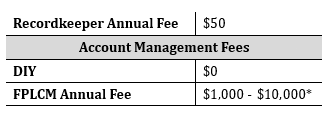

PARTICIPANT FEES

*FPLCM is a flat fee-only asset management firm. The flat annual fee is not based on the size of the account, but is determined by the level of service selected. Please refer to the FPLCM Advisory Fee Schedule below for FPL Capital Management’s annual management fees. All SDBAs managed by FPLCM are subject to a $250 setup fee.